why are reits tax efficient

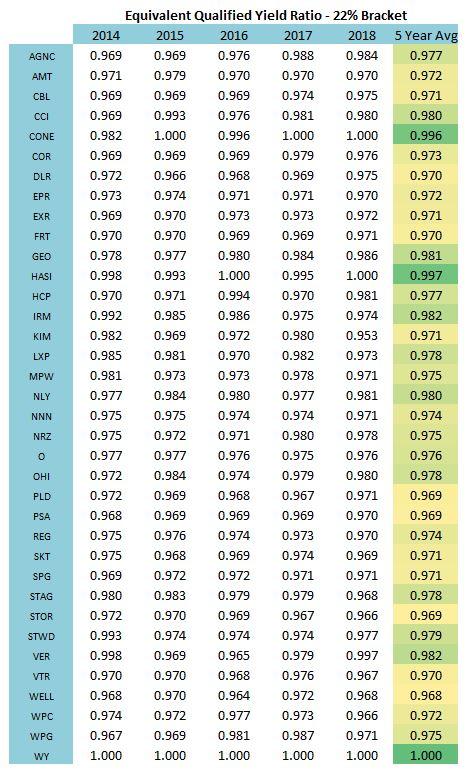

Potential Market Inefficiency Due to the weird legal structure of. While REITs are less tax efficient than qualified dividend-paying US equities the extent of their inefficiency is overstated and misunderstood.

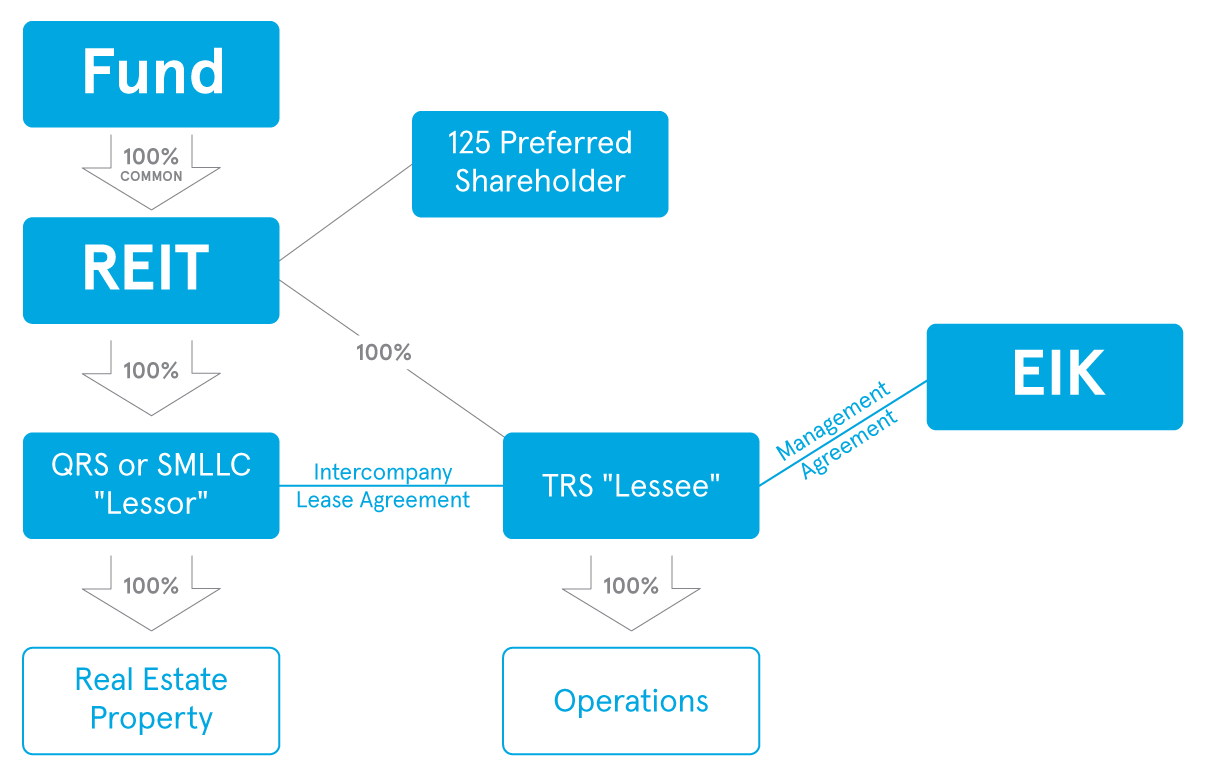

Taxable Reit Subsidiaries Q A Primer

REITs correlation value is about the same as that of dividend stocks another income-producing asset class that is more tax-efficient than REITs.

. 2 Investors should be aware that a REITs. REITs Can Enter Real Estate Related Businesses to Boost Returns. REITs pay out roughly 65 of their distributions.

REITs receive special tax treatment--the deduction of dividend payments. REITs are a tax-efficient diversified alternative to direct real estate ownership and investment. Why are REITs tax efficient.

10 hours agoConsider reviewing your retirement accounts and maximizing your 401 k or IRA contributions to take advantage of potential opportunities. Why Are REITs Tax Efficient. Malkiel of Wealthfront found that the.

REITs are tax efficient for many reasons. ROC is a tax designation which considers taxable income after non-cash tax accounting adjustments such as depreciation and amortization. Since REITs are required to distribute 90 of their annual taxable income to investors REITs are allowed to avoid taxation.

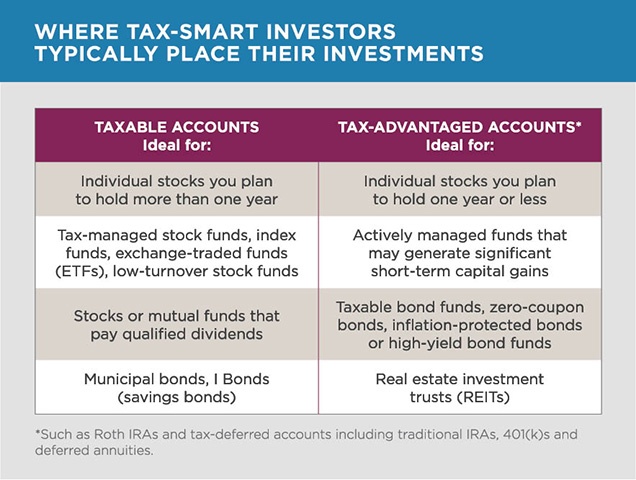

Theres another reason to put REITs in tax-advantaged accounts. When you hold shares of a REIT you are an actual owner of real estate. Tax-advantaged accounts like IRAs and 401 ks have annual contribution limits.

For 2021 and 2022 you can contribute a total of 6000 to your. Heres an excerpt from the Wiki. A REIT is a tax-efficient vehicle that gives people exposure to a diversified portfolio of income producing.

Regarding the tax efficiency of REITs I think its worthwhile to point out that while they arent as tax efficient as stock index funds they are far more efficient than taxable bonds. Their dividend tax rate is much higher than dividends on stocks. Thats why our service.

An analysis of Burton G. A REIT is a tax-efficient vehicle that gives people. Consider collaborating with your.

REITs by their very structure are not particularly tax-efficient As long as a REIT pays out more than 90 of net income it pays NO. ETFs are vastly more tax efficient than competing mutual funds. REITs offer incredible tax advantages.

For example they dont pay corporate income taxes return of capital distributions are tax-deferred. We Advise More REITs than Any Other Professional Services Firm. Real Estate Investment Trusts REITs are known as a tax efficient way to invest in real estate.

Tax-Efficient Investing Strategies. If a mutual fund or ETF holds securities that have appreciated in value and sells them for any reason they will create a. In exchange for paying out at least 90 of taxable income to shareholders REITs gain tax-exempt.

Tax Efficiency By holding a REIT in my Roth I can lower my tax rate on REIT income from 24 to 0.

Reit Tax Efficiency A Case Study Fundrise

Section 199a Qbi Deductions For Reits Vs Direct Real Estate

What Is A Reit And Should I Invest In Them Personal Finance Club

What Is A Reit Reit Tax Advantages Cpa Firms Atlanta Ga

The 5 Most Tax Efficient Investments And Which Investments To Avoid In Taxable Accounts Valuist

Reits Revisited A Closer Look At Tax Efficiency And Returns Pimco Commentaries Advisor Perspectives

Asset Location Best Accounts For Different Investments

Cons Of Reits Disadvantages Of Reits Reit Dividend Taxation

Qoz Investing Reits Versus Llcs As Fund Structures Origin Investments

The Key To Tax Efficient Investing Asset Location

Are Reits As Attractive As We All First Thought Financial Times

How Tax Efficient Are Your Reits Seeking Alpha

Real Estate Investment Trusts What Are Reits

3 Tax Smart Alternatives Cohen Steers

Ideal Placement Location For Investments Taxable Vs Non Taxable Accounts Topforeignstocks Com

What Is A Reit Reit Tax Advantages Cpa Firms Atlanta Ga

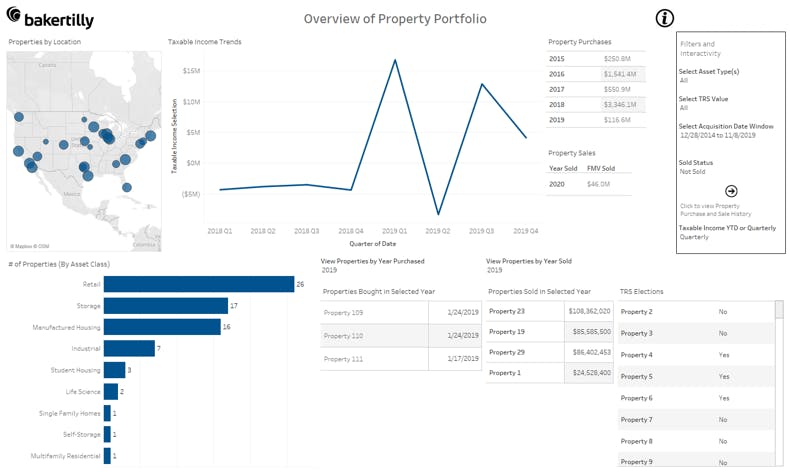

How Reits Can Leverage Financial Analytics And Dashboard Reporting To Drive Success Baker Tilly

Investors Warming To Midstream Energy Reit Model S P Global Market Intelligence

Tax Aspects Of Investing In Reits And Remics The Cpa Journal